Compound interest calculator quarterly deposit

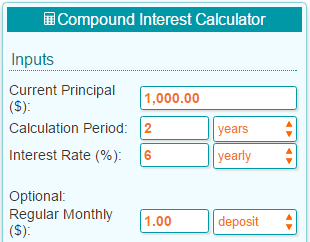

Visit ICICI Direct to calculate compound interest online for free. For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually.

Compound Interest Calculator Daily Monthly Quarterly Annual

How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued.

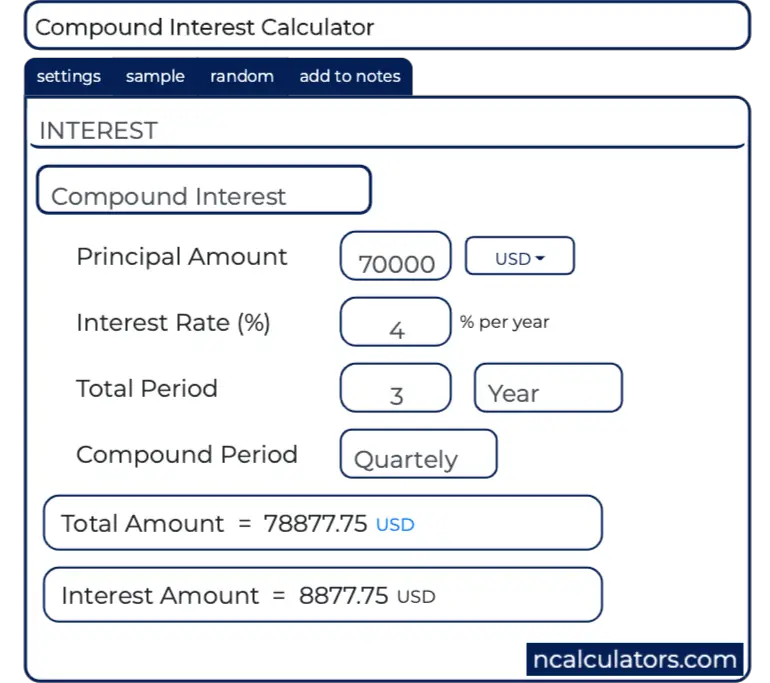

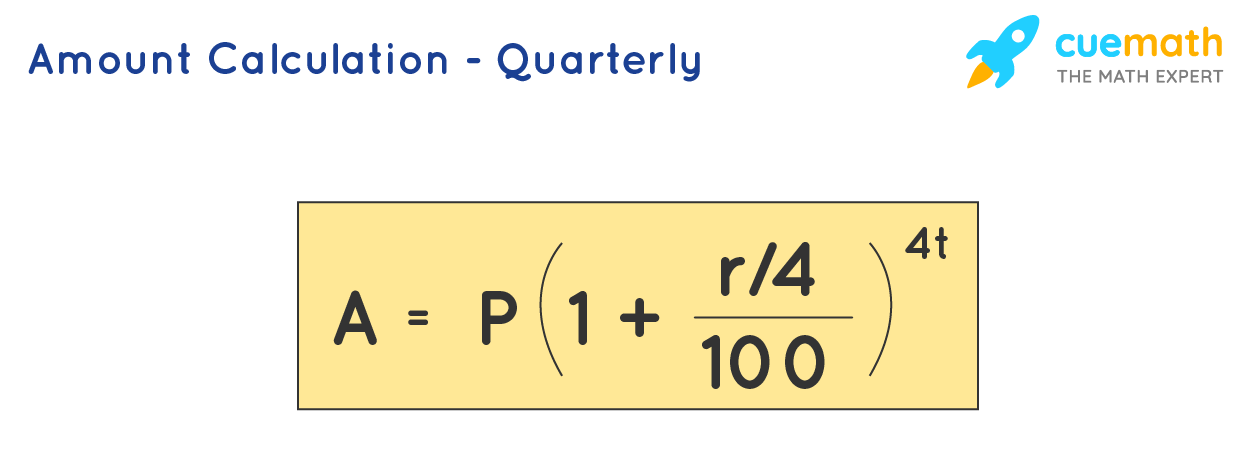

. R is the annual interest rate. 4 Quarterly 6 Bi-Monthly 12 Monthly 24 Semi-Monthly 26 Bi-Weekly 52 Weekly. Varying deposit compounding intervals can make calculations quite complex so if you plan on investing at.

How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued. Quarterly 4 Bi-Monthly 6 Monthly 12 Semi-Monthly 24. Use our free compound interest calculator to estimate how your investments will grow over time.

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. T the time the money is invested or borrowed for. See how compound interest can increase your savings over time.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. Thought to have. Even small deposits to a.

Youre not only earning interest on your initial deposit but youre. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Online Compound Interest Calculator - Use ClearTax compound interest calculator to calculate compound interest earned daily weekly monthly quarterly annually.

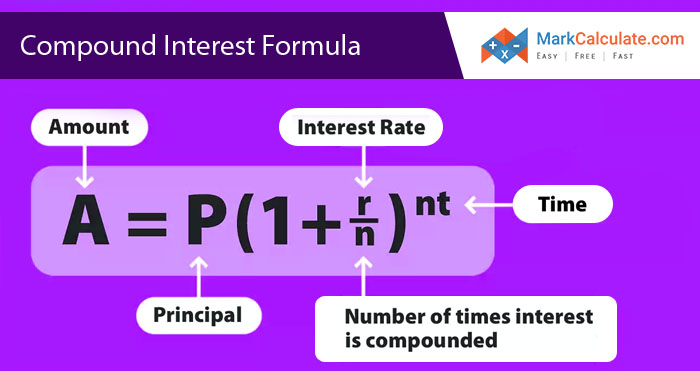

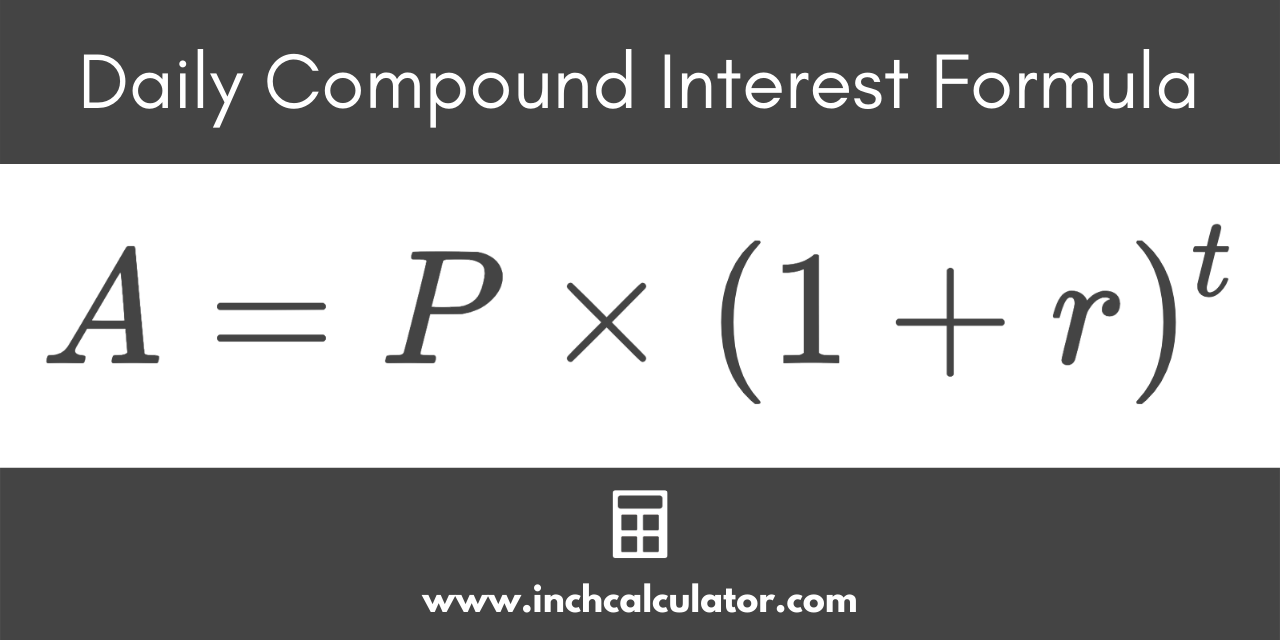

The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration. The results you get from a daily interest calculator will only be different from compound interest calculator quarterly results in the periodic sense. P is principal or the original deposit in bank account.

Simply enter the details of the principal amount interest rate period and compounding frequency to know the. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Year 3 would see a monthly deposit of 10609.

In line with Kailuas request above I am seeking an excel formula for compounding interest with a STARTING monthly deposit of 100 invested at 7 per year compounded annually and increasing the monthly deposit by 3 per year ie. That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period. Years at a given interest.

After a year youve earned 100 in interest bringing your balance up to 2100. It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Which is better - an investment offering a 5 return compounded daily or a 6 return compounded annually.

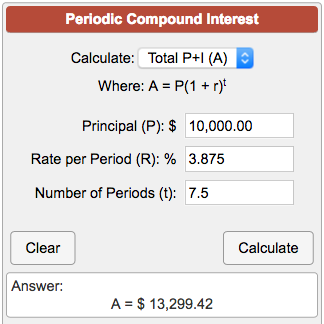

To compute compound interest we need to follow the below steps. R the annual interest rate decimal. A fixed deposit calculator is a tool designed to get an estimate about the maturity amount that the investor should expect at the end of a chosen tenure for a specified deposit amount at the applicable rate of interest.

Compound Interest is calculated on the initial payment and also on the interest of previous periods. Calculating quarterly compound interest is just like calculating yearly compound interest. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

After one year you will have 100 10 110 and after two years you will have 110 10 121. Include additions contributions to the initial deposit or investment for a more detailed calculation. Investing on a monthly basis instead of on a quarterly basis.

Hello Sir i was trying to calculate compound interest for years that are in decimal. Find out the initial principal amount that is required to be invested. Any disposable income you can deposit in your.

My initial deposit is 5000 my MONTHLY Interest Rate is 5 which should be. T is the number of years. Think of this as twelve different compound interest calculations one for each quarter that you deposit 135.

By using the above methods I have created a cumulative interest calculator Template to calculate all of the above calculations for interest in a single worksheet. For example if we assume we invested 100 at a 26 rate compounded annually for 1195 days and i use this basic excel formula 1001261001195365 and result is 2131132 and if i do the same calculations in your calculator it shows 21414 please help to explain the difference. Our compound interest calculator will help you discover how your money could grow over time using the power of compounding interest.

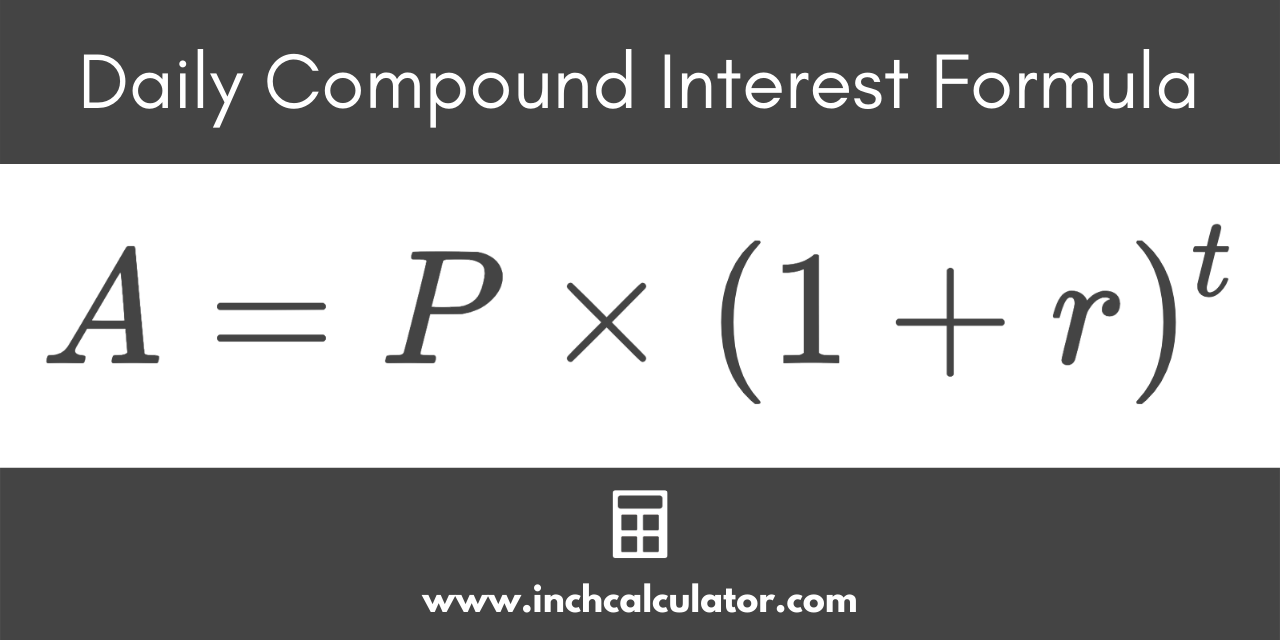

Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Compound interest is calculated using the compound interest formula.

The interest can be compounded annually semiannually quarterly monthly or daily. After a year youve earned 100 in interest bringing your balance up to 2100. Compound Interest Explanation.

Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. How to calculate compound interest. The most common compounding frequencies are daily weekly monthly quarterly half-yearly and annually.

See how much you can save in 5 10 15 25 etc. At the end of three years simply add up each compound interest calculation to get your total future value. Compound Interest Calculator helps in accurate compound interest rate calculation in seconds.

In the spirit of being more competitive more banks are offering daily compounding so this is the variable you are more likely to be applying. The following calculator allows you to quickly determine the answer to these sorts of questions. Compound Interest Calculator is a ready-to-use excel template that helps to calculate compound interest with multiple compounding periods.

Suppose you give 100 to a bank which pays you 10 compound interest at the end of every year. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Subtract the initial balance if you want to know the total interest earned.

P the principal investment amount the initial deposit or loan amount. N the number of times that interest is compounded per unit t. For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually.

Choose daily monthly quarterly or annual compounding. Year 4 would see. For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at.

Year 2 would see a monthly deposit of 10300. Note These formulas assume that the deposits payments are made at the end of each compound period. Which also includes all the accumulated interest of previous periods of a deposit.

Its worth noting that this formula gives you the future value of an. The calculation formula is. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that.

Compound interest P 1rn nt - P. A the future value of the investmentloan including interest.

Compound Interest Formula And Calculator Excel Template

Compound Interest Calculator Markcalculate

Compound Interest Calculator With Formula

Compound Interest Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Ci Formulas Calculator

Periodic Compound Interest Calculator

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Compound Interest Formulas Derivation Solved Examples

Excel Savings Interest Calculator Personal Tools Simple Compound Interest Savings Tracker Spreadsheet Printable Savings Sheet

Compound Interest Definition Formula How It S Calculated

Compound Interest Excel Formula With Regular Deposits In 2022 Excel Formula Compound Interest Excel

Compound Interest Ci Formulas Calculator

Compounding Interest Calculator Yearly Monthly Daily

Daily Compound Interest Calculator Inch Calculator

Daily Compound Interest Formula Calculator Excel Template

Excel Savings Interest Calculator Personal Tools Simple Compound Interest Savings Tracker Spreadsheet